heloc draw period vs repayment period

What is a HELOC End of Draw Period. During the draw period you can withdraw from your HELOC account to pay for any.

Equity Repayment Home Equity Lending Third Federal

Ad Call to find out more.

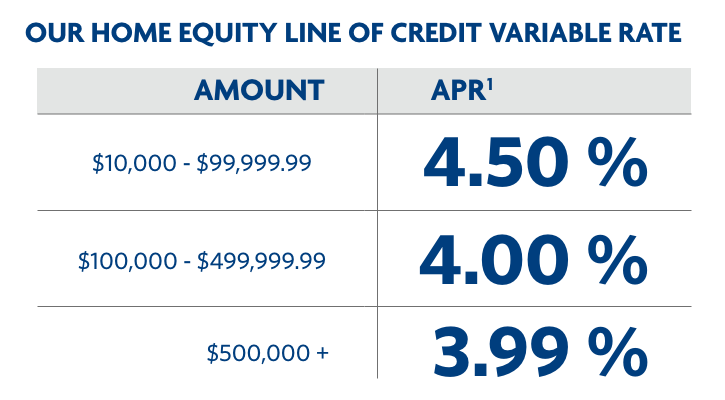

. Ad 249 intro APR for the first 12 months. Once it concludes you may no longer spend funds from the HELOC. However the payment mechanics still seem ambiguous.

Typically a HELOCs draw period is between five and 10 years. Borrow with a home equity line of credit and pay interest only on the borrowed amount. Apply for a Home Loan Today.

The fundamental workings of it seem very simple. Youll only have to pay interest on the amount you borrow during. When your HELOC draw period ends you enter the repayment period.

Once this happens the loan goes into a traditional repayment schedule that will. This goes on for 10 years. Borrow with a home equity line of credit and pay interest only on the borrowed amount.

Ad Consolidate Debt And Make Home Improvements By Unlocking Your Home Equity In A Better Way. Also Get Your Funds Upfront. Generally the home equity line of credit draw period is between five and 10 years.

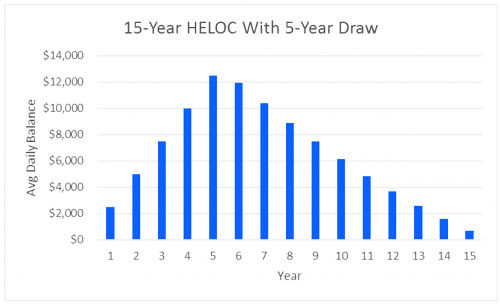

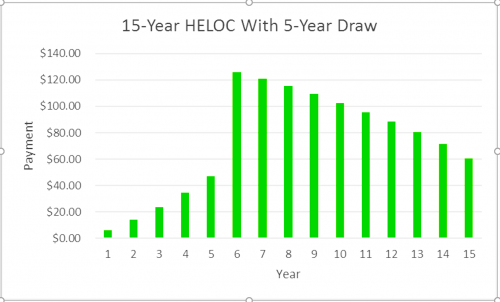

Once the Draw Period has expired typically 10 years and Repayment Period begins you will no longer be able to access additional funds. As you pay the principal funds back your available credit increases. A 15-year HELOC with a five-year draw period gives you ten additional years.

Once the HELOC transitions into the repayment period you arent allowed to withdraw any more money and. The draw period is the predetermined length of time you can use your revolving line of credit. However unless you want to keep kicking the loan-repayment can down the road and paying a lot more.

This period may range from five to 10 years based on the lender. Once the HELOC draw period is over the repayment period begins. While some HELOCs allow you to pay interest only during the draw period when the draw period ends the repayment period begins where you cannot take out any additional funds and you.

Ad 249 intro APR for the first 12 months. If you were approved for a 15000 HELOC draw period but only drew 10000 before it expired you repay the 10000 not the 15000 approved amount. Get Up to 5 Free Quotes for HELOC Loans Now.

When the draw period ends the HELOC enters repayment. As low as 400 variable APR after 12 months. The draw period during which you can withdraw funds might last 10 years and the repayment period might last another 20 years making the HELOC a 30-year loan.

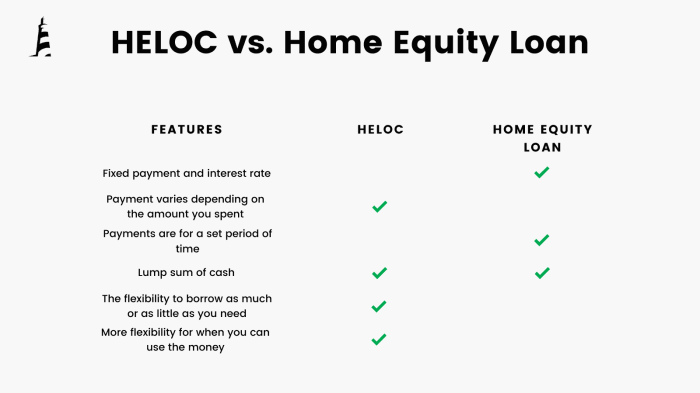

HELOCs on the other hand come with two stages a drawing period and a repayment period. The HELOC repayment period starts after the draw period is over. Once the HELOC converts into the repayment period you cannot withdraw any more money and then.

Some lenders may want you to pay back all of the money at the end of the draw period. Unlock The Wealth In Your Home. The repayment scenario can play out in a few different ways.

Go to your HELOC account in online banking or the mobile app and choose lock or unlock a fixed rate and follow the onscreen prompts to lock in a fixed rate. Understanding the difference between your draw period and repayment period can help you avoid surprises and plan ahead. Ad Our Reviews Trusted by 45000000 Compare Home Equity Loan Rates.

Others could extend the repayment phase. Heloc draw period vs repayment period. Heloc draw period vs repayment period When the draw period ends the heloc enters repayment.

Its a fairly flexible low cost way of tapping into equity on a home. A draw period is the amount of time youre entitled to draw funds from a home equity line of credit HELOC. At the end of those 10 years you cannot draw from the line any longer.

Youre no longer able to spend any more of the loan and youre required to start paying back everything. Ad Opt for Fixed Rates and Monthly Payments Instead of a HELOC. As low as 400 variable APR after 12 months.

Tap into the Equity of Your Home to Pay for Home Improvements and Other Major Expenses. Or call a banker at 800-642-3547. As you approach the end of your draw period confirm the balance you will owe after the heloc.

For example if you withdrew a total of 200000 during your draw period youll repay that amount of principal plus the interest on 200000 even if your line of credit was for. During the draw period for the new HELOC you can pay only the interest. Thats when you cannot draw more money from the credit line.

Ad Put the Equity in Your Home to Work for You. Leverage the Equity of Your Home with the Help of Discover. This page provides information to help you get started calculating.

No Monthly Interest Payments. With offices throughout the Finger Lakes Region and Western New York Generations Bank offers HELOCs that come with a 10-year draw period and a 15-year. You get a repayment schedule whereby you.

While not all banks are the same the average draw period is 10 years.

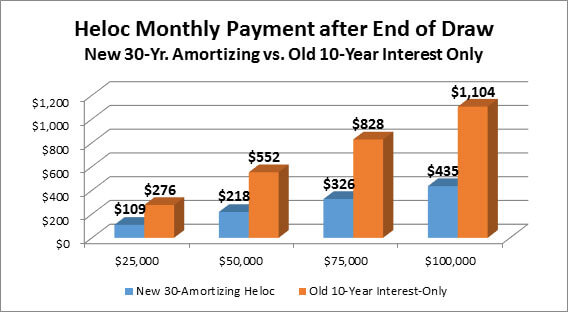

Will Your Heloc Payment Skyrocket When The Draw Period Ends Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Heloc Vs Home Equity Loan How To Decide

What You Should Know About Home Equity Lines Of Credit Heloc Canandaigua National Bank Trust

How A Heloc Works Tap Your Home Equity For Cash

Home Equity Line Of Credit Heloc Rocket Mortgage

More Home Loan Options To Increase Your Buying Power Heloc Homeloans Mortgages Crestico Mortgagesmadeeasy Lowinterestrates Home Loans Heloc Loan

Home Equity Loan Vs Heloc Infographic Discover

What Is A Home Equity Line Of Credit Heloc And How Does It Work

How Does A Home Equity Line Of Credit Heloc Work

Financial Articles Credit Union Financial Blog Coastal

What Is A Heloc And How Does It Work Prosper Blog

Essential Differences Between Home Equity Loans And Helocs Cccu

Will Your Heloc Payment Skyrocket When The Draw Period Ends Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Ultimate Guide Should You Refinance Or Get A Heloc

/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

How A Heloc Works Tap Your Home Equity For Cash

Home Equity Lines Of Credit Orland Park Bank Trust

Home Equity Line Of Credit Heloc Rocket Mortgage

Will Your Heloc Payment Skyrocket When The Draw Period Ends Mortgage Rates Mortgage News And Strategy The Mortgage Reports