modified business tax id nevada

If you dont however have this information readily available this simple form can end up taking hours to complete. How do I change my modified business tax return in Nevada.

Modified Business Tax Return Form Nevada Fill Online Printable Fillable Blank Pdffiller

How you can complete the Nevada modified business tax return form on the web.

. Employers who pay employees in Nevada must register with the NV Department of Employment Training and Rehabilitation DETR for an. Your Nevada Modified Business Tax number should be listed. For assistance call 775-687-4545 Nevada Account Number or 866-962-3707 MBT Number.

2 days agoSilverFlume is simple to use and offers the following corporate entity search options. Email the amended return along with any additional documentation to email protected OR mail your amended. Account Numbers Needed.

Search by Business Name Search by NVBID Search by Business Address. Click here to schedule an appointment. In Nevada there is no state-level corporate income tax.

NV Business ID Number. Sign Online button or tick the preview image of the blank. The Tax IDentification number TID is the permit number issued by the Department.

If you have quetions about the online permit application process you can contact the Department of Taxation via. Searching the TID will list the specific taxpayer being researched with its affiliated locations. For additional questions about the Nevada Modified Business Tax see the following page from the.

Ask the Advisor Workshops. Enter your Nevada Tax Pre-Authorization Code. TID Taxpayer ID Search.

Modified business tax id nevada Thursday July 7 2022 Edit. Once youve found your business click on the View Details button and scroll down to the Tax ID section. Use this as your opportunity to get.

Nevada Department of Taxation PO Box 7165 San Francisco CA 94120-7165. Gross wages payments made and individual employee information. It requires data and information you should have on-hand.

To get started on the blank use the Fill camp. This tax is paid by the employer during a calendar quarter on amounts that exceed. The Nevada Modified Business Return is an easy form to complete.

Imposition of excise tax at the rate of 1475 of the wages paid by an employer. However you may owe a modified business tax MBT rate of 117 percent if taxable wages exceed 62500 in a quarter. Modified Business Tax Return-Financial Institutions 7-1-19 to Current This is the standard quarterly return for reporting the Modified Business Tax for Financial Institutions as.

Clark County Tax Rate Increase - Effective January 1 2020.

.jpg)

Https Www Nevadatreasurer Gov Ggms Ggms Home

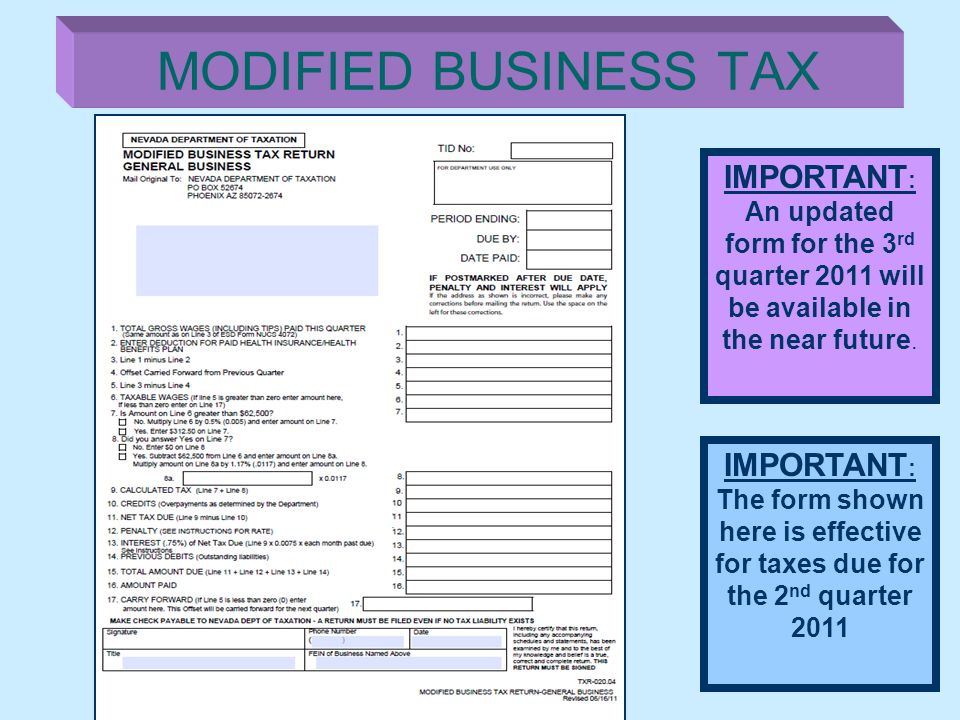

State Of Nevada Department Of Taxation Ppt Video Online Download

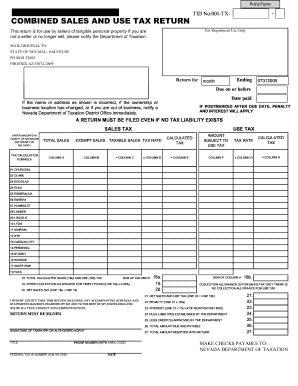

Nevada Sales Tax Fill Out And Sign Printable Pdf Template Signnow

State Of Nevada Department Of Taxation Ppt Video Online Download

Nevada State Tax Golddealer Com

2022 State Income Tax Rankings Tax Foundation

How To Register For A Sales Tax Permit In Nevada Taxvalet

Nevada Modified Business Tax Form 2019 Pdf Fill Out Sign Online Dochub

Have You Not Collected Or Remitted Your Nevada Sales Tax Yet Consider The Voluntary Disclosure Program Sales Tax Helper

Nevada S Golden Child High Country News Know The West

Obtain A Tax Id Ein Number And Register Your Business In Nevada Business Help Center

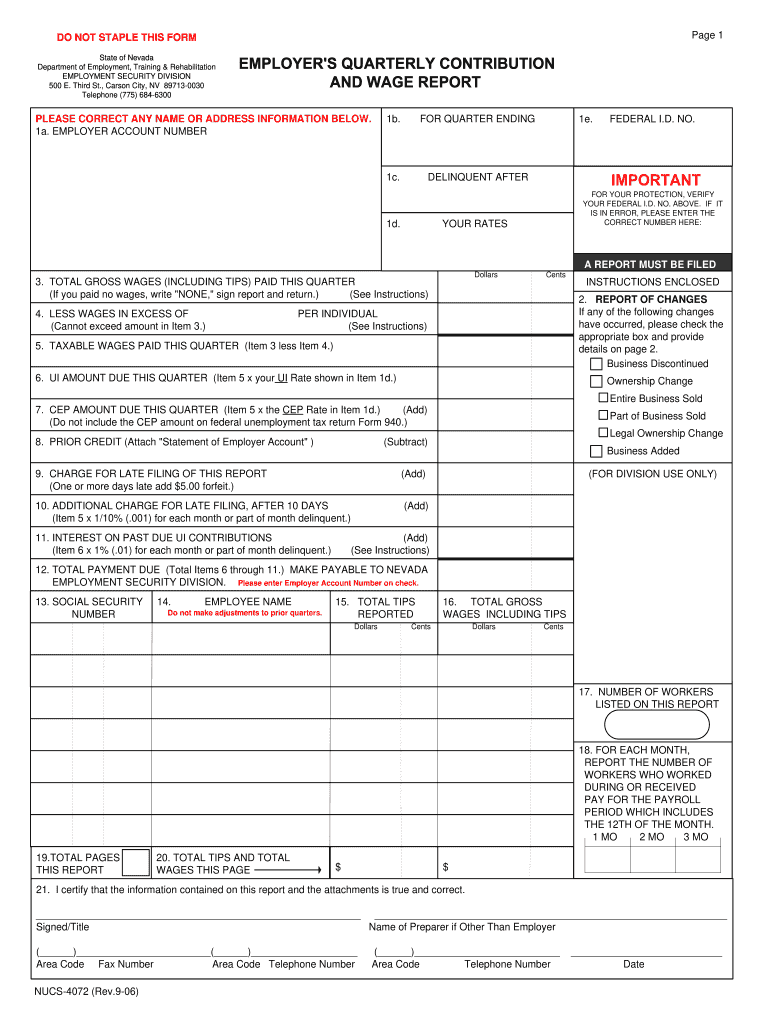

Form Nucs Nevada Fill Online Printable Fillable Blank Pdffiller

Nevada Llc How To Start An Llc In Nevada Truic

Htts Uitax Nvdetr Org Fill Out Sign Online Dochub

Sisolak Under Fire For Job Killing Taxes In New Ad By Gop Governors Linked Group The Nevada Independent

Marginal Tax Rates For Pass Through Businesses Vary By State